It's never lonely being a baby boomer - there's lots of us to go around. Sometimes I feel like we're sitting on a financial time-bomb.

Lately I've read articles about how the boomers are messing up the housing market because we stay in our homes longer than previous generations. One article said this is keeping the millennials from realizing their home ownership dream because affordable starter homes are not going on the market.

Even though many of the boomers have paid off their mortgages, eventually the property taxes and upkeep eat into their fixed income, so they will start thinking of down-sizing. However, since there is a relatively small age range, many houses are going to hit the market at the same time, most likely driving the prices down.

The next article said nobody wants those too-big, traditionally-designed baby boomer homes anyway. The millennials want smaller houses, minimally designed. They aren't impressed by the crown moldings, grand entryways, and traditional floor plans so treasured by the boomers. There are quotes about how back in the day people didn't build or buy modern style minimalist homes because they were afraid they couldn't re-sell them. Now, those homes are the most desirable. The article predicted that when the boomers are ready to sell, there are going to be a lot of homes sitting on the market.

On a personal level, many homes in my neighborhood, which is a narrow strip of homes along a river in a steep-walled river canyon, have come on the market lately, with more coming soon. All of the sellers are baby boomers. Modest, older cabin-type houses are listed for $450,000 to $735,000, and many of the sellers inherited them or paid around $100,000 for them many years ago.

Despite our very recent history of disastrous flooding, homes on the river are considered the most desirable, and the county figures the recreational value (without structures) of river frontage is $1 million per mile, driving the prices up. Because many of them were designed/used as second homes that for years were not used year-round, they tend to have that minimalist style that is supposed to appeal to younger generations. Hopefully, they have saved up so they can make the down payment - or they can get help from their baby boomer parents.

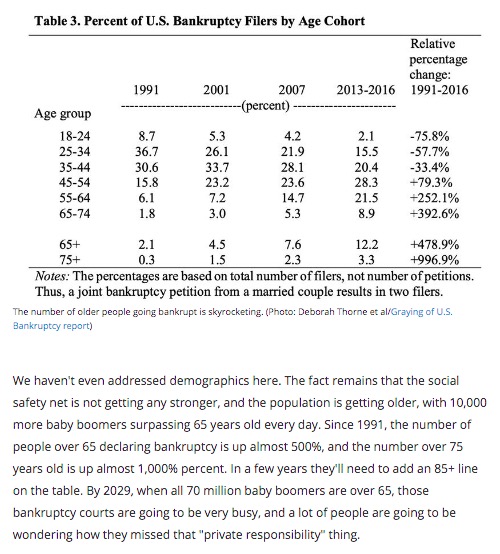

Today, I saw an article about the baby boomer age group is taking out bankruptcy in unprecedented numbers. "Seniors are living longer and paying ever higher medical costs for the privilege of staying alive; many have little or no company pension and scant personal savings to fall back on. Many are also helping their kids, even buying diapers for grandchildren, and have been unable to build up a nest egg."

I remember how the Great Recession in 2008 hit a lot of boomers especially hard because they were laid off from good-paying jobs that they'd worked their way up into without college degrees; they couldn't compete with younger, just-as- or (supposedly) more-qualified people in the job market, so they ended up dipping into their retirement funds and home equity earlier than planned. Some of them had already dipped into home equity to finance their lifestyle, and many lost their homes.

We can blame healthcare and living costs that are not covered by Medicare, but the article points out that there's more to it:

"Americans need to plan around potential illnesses by rethinking their debt load. We’d all be much less vulnerable if we kept our debt payments down to a level that would be manageable on a reduced income, instead of buying as much car and home as we can afford."

Here's the article: "Why more boomers are going bankrupt

It's not just medical expenses; the entire social safety net is in tatters."

I'm looking forward to what will come next.

for those children? They seem to expect to start out at the same level

as their parents and home ownership is not in their grasp.